Tag: finance

-

ROCE, ROIC, ROE: What really matters

Key takeaways There are many ways of valuing companies and the returns they are expected to produce in the future. Price to earnings ratio and revenue/profit growth rates are very popular, they are good but don’t tell the whole story. Some of the worlds best investors focus on metrics called Return On Capital Employed (ROCE)…

-

Credit cards are expensive, aren’t they??

Key Takeaways Credit cards are a way of borrowing money, with most adults having at least one card in the UK. They are known for having a relatively high interest rates, typically starting around 20% per year but they can run much higher. I use credit cards a lot, however they are my lowest cost…

-

Vistry – Will the strategy shift work?

Key Takeaways Vistry Group may not be the most recognisable name to many, they are a housebuilder in the UK and currently listed on the FTSE 250. Housebuilders have had a difficult few years, largely down to the interest rate rises that began in 2022. A large portion of houses are bought with mortgages, the…

-

Options for Investing

Key Takeaways As a resident of the UK, choosing to invest using an ISA is an easy decision due to their tax benefits. But then when it comes to choosing investments, the shear number available and the different types start to make it much harder. I have a Stock & Shares ISA with Barclays, a…

-

Carnival Corporation – Sailing out of rough waters?

Key Takeaways Carnival (LSE:CCL, NYSE:CCL) is the largest cruise company in the world and the only cruise company available on the London Stock Exchange. The cruise industry was one of the most impacted by the Covid-19 pandemic. Carnival survived the worst of the pandemic but was left badly damaged, kept afloat through binging on debt…

-

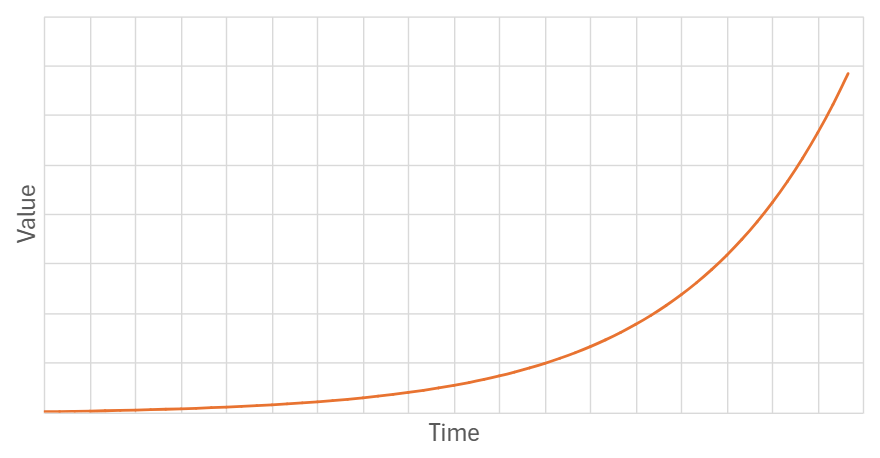

Compounding

Key Takeaways The number one thing that triggered my interest in investing and has influenced my decision making was the concept of compounding and what it is capable of. Nothing can demonstrate compounding better than a graph… An initial £1 turns into £2.60An initial £100 turns in £260An initial £10,000 turns in £26,000 Starting with…