Key Takeaways

- Used properly, credit cards are the cheapest way to borrow.

- Make use of the different types of promotional offer.

- Keep focused and have a plan to avoid undoing the benefits.

Credit cards are a way of borrowing money, with most adults having at least one card in the UK. They are known for having a relatively high interest rates, typically starting around 20% per year but they can run much higher.

I use credit cards a lot, however they are my lowest cost form of debt. When I say lowest cost, they don’t actually cost me anything in monthly interest and I’ve never paid a penny of interest on any credit card whilst continually carrying a balance for year after year, and plan to continue doing so for decades.

I am able to do this through the type of credit cards I use and when I use them. The 20%+ interest rate applies, but most cards come with a promotional offer for a period of time where the normal interest rate doesn’t apply. In some cases small fees do apply, but there are cards out there that don’t come with any fees. So the total cost of borrowing with these cards can be nothing! With a bit of planning, credit cards go from being one of the most expensive ways to borrow to quite literally, free.

There are a few different types of credit card promotions available designed to be used in different situations.

Purchase cards

Like the other types of credit card, the name is fairly self explanatory. For purchase cards, a 0% interest rate is applied to purchases made with the card. The catch is this promotion typically only applies to purchases made within the first 60 days of opening the account, although this varies. The terms and conditions of each card states this. After that period, any purchases will be charged at the normal interest rate on the card.

Currently the longest periods of 0% interest offered are up to 21 months. Although cards with ‘up to X months’ aren’t always given in full and a shorter but definite period may turn out to be what is received. None of the cards come with fees so they truly are free, until the 0% interest free period expires.

Balance Transfer cards

Balance transfer cards are aimed at transferring outstanding credit card balances from one credit card to another. Customers are encouraged to do this with a 0% interest rate offered on a new card for balances transferred to it. This transfer will avoid the 20%+ interest that is likely due to be charged on the existing card.

The savings that can be made from moving a balance from paying a typical interest rate to a 0% rate are big. A small fee is typically due for the transfer but cards are available that charge no fee, making the cost of transferring to and borrowing on these, free.

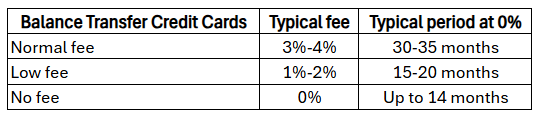

The difference in fees charged usually effects how long the 0% interest rate lasts, with a guide below. These promotional periods offered now (October 2025) are shorter than a few years ago.

Money Transfer cards

Another offer that may be available are money transfers. These transfer a cash balance to your current account from the card without having to buy anything, so is very similar to a loan. The interest on this is typically 0% for the promotional period but a money transfer fee always applies, this is normally around 5% of the borrowed amount.

Rewards cards

Reward cards are the final type of credit card. In exchange for spending with the card, various rewards are given to the card holder. These rewards usually are in the form of cashback or loyalty points that can be exchanged for vouchers or air miles for flights etc. This type of card is different to the others as you don’t get the 0% interest promotion period. Benefits from reward cards only really make a difference when a lot of money is spent on the credit card each month.

Things to consider

The promotional periods offered on credit cards are subject to continued monthly payments of at least the minimum monthly payment for the card, otherwise the offer can be taken away instantly and the interest rate charged reverts to normal.

The minimum monthly payments are typically 1-2% of the outstanding balance, setting up this monthly payment as an automatic standing order removes the risk of forgetting about it and losing the promotional offer.

Credit cards and credit scores go hand in hand; the total credit limit, credit usage and payment history that impact credit scores all apply to credit cards. A higher credit score boosts the odds of getting approved for a credit card and a credit card(s) is needed to have a credit limit and evidence of a payment history. As having credit cards is necessary, I may as well make full use of them to my advantage.

How I use them

I realised the real benefits of credit cards back in 2019 when thinking about buying a first home. Initially I used a credit card to boost my credit score prior to applying for a mortgage, it was then I discovered all the credit card offers available and quickly recognised the benefits.

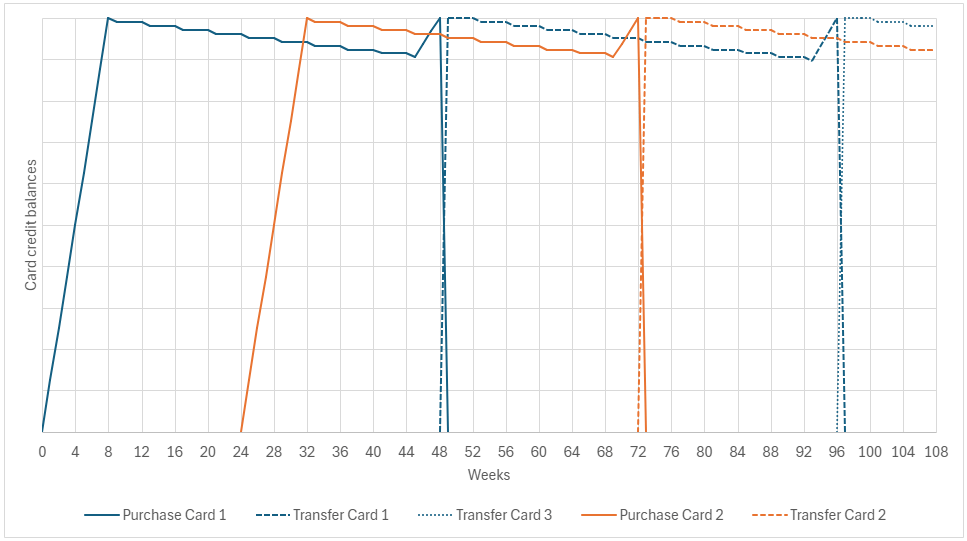

I currently carry a total credit card balance of about £20,000, this is against a total credit limit of £57,000 across 6 cards. Realistically this is 2 cards with £10,000 on and 4 ‘old’ cards out of their promotion offers with no balance.

Over the 6 years since; I have used purchase, balance transfer and money transfer credit cards. Initially a few purchase cards were used. These were loaded with purchases at the time, but always things I needed and nothing extra just for the sake of spending money, this would quickly eat into any of the gains. Remaining council tax payments were paid in one go, energy bill accounts credited with a lump sum, topping up a few reloadable grocery shopping cards available through work, paying a years worth of car insurance, the lists goes on.

I then moved on to some balance transfer cards to transfer the balances of the initial purchase cards across when their promotions expired. Additional spending on the purchase cards within a month of transferring made better use of the credit limit for no charge. An example provided below for context.

I chose no fee balance transfer cards 0% as promotional periods of 20 months were available at the time, keeping the cost at £0. Cards with transfer fees were available for up to 36 months then. In more recent years, balance transfer cards with no fees have only been available for 12-15 months promotional periods.

I have also used a money transfer card due to a good offer on it. For an old purchase card with an expired offer that sat in my drawer, I received a random email offering a new money transfer of 0% for 18 months for just a 3% fee. This was at a time the UK consumer price inflation was 3.9%, the UK base rate was 5.25%, mortgages were around 5-6% and bank savings accounts were offering around 5% interest per year.

I was guaranteed to make money, the email should of said ‘Have a guaranteed £450+ over the next 18 months’. Receiving advertising emails is annoying, but this opened my eyes to what they could offer and it is worth tolerating them. I turned on the marketing option to hopefully receive more offers like this.

Timing

The timing of applying for replacement cards is important to avoid being charged interest when the existing run out. Credit scores are also impacted if accounts are opened within 6 months of each other. I have to look out into the future as well to check existing cards with promotional periods don’t expire too close to each other, they will both need to be paid off or rolled over onto a new card(s) to avoid high interest payments.

I also have to make sure I apply for and receive the new card in time, before the interest starts being changed on existing cards. I prefer to apply early rather than later to make sure it arrives in time.

It pays me to do this

Considering the £20,000 total outstanding balance currently borrowed at 0% has allowed me to put £20,000 more into my ISA, achieving the long term 10% target return in the ISA means I get paid £2,000 on average each year I do this. That is the easiest £2,000 I earn!

Risks

With all the positives, I’m always wary of the down sides. All the money saved by using the promotional rates could be quickly undone by having to pay standard rates of interest, even for a short period. I set myself reminders of when the promotions end and make sure I could pay off the balance of a card coming due with money in my bank or investment accounts if it came to it.

I also make sure that automatic direct debits are setup and actually work to ensure at least minimum monthly payments are made. I don’t want to lose a interest free offer early because of this. Once I know it is working, I don’t have to check again.

Future

I’m looking to continue utilising the 0% promotional offers on credit cards for years to come. They have been very useful whilst being relatively young to free up money for maxing out the annual contributions to my ISA each year. From the Compounding article, I know how important it is to start early with my ISA investments!

But it makes sense to continue employing this strategy as it pays me. With £20,000 currently borrowed, I look to increase this further over the coming years. This is money borrowed at almost no cost, so lower interest rates than my mortgage and student loan. It would make sense to pay off my mortgage or student loan, that I pay interest on, first before clearing credit cards that charge 0%.

This is how credit cards can be turned into the cheapest way to borrow money and something that can actually pay me!