Key Takeaways

- Market’s loss of confidence in the company provides opportunity.

- On paper, the planned medium term strategy shift is promising.

- Well placed to provide potential solutions to UK’s long term issues.

Vistry Group may not be the most recognisable name to many, they are a housebuilder in the UK and currently listed on the FTSE 250. Housebuilders have had a difficult few years, largely down to the interest rate rises that began in 2022.

A large portion of houses are bought with mortgages, the monthly cost of these mortgages increase with the interest rates and reduces their affordability. When house prices hold steady as they have done, it gets to a point where they become unaffordable for a number of buyers, so the demand for houses drops. The interest rates are at the highest level for over 15 years and have been noticeably lower in between, so the market, and people, had got used to that.

Background

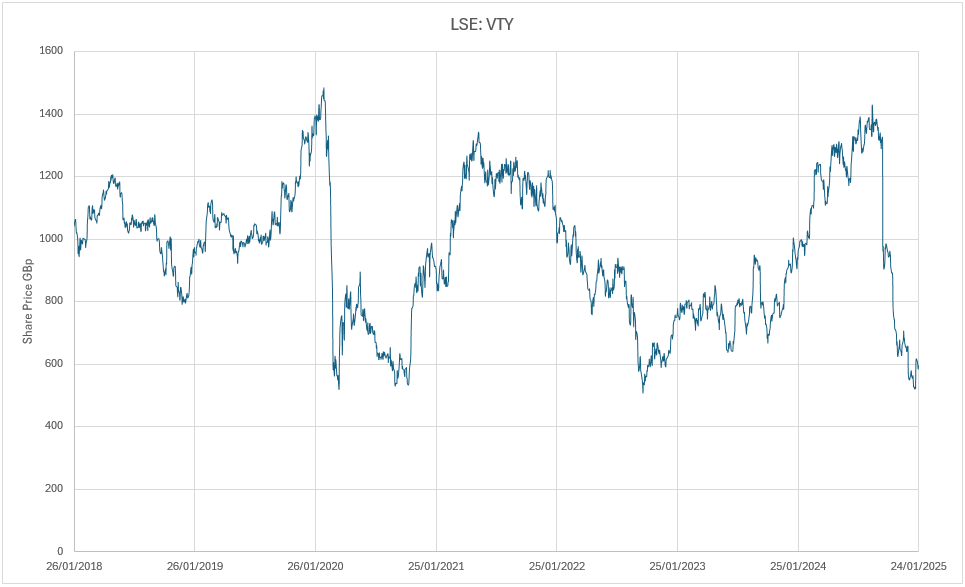

Interest rates in the UK peaked in August 2023 and a month later, Vistry announced half year results which included a strategy shift. A shift to a more asset light model that returned the excess cash released over 3 years from this change, to shareholders. This is very positive on multiple levels and the share price climbed 60% over the following 12 months.

Opportunity

I had been interested in housebuilders in early 2024 as it was evident by then interest rates had peaked and were likely to turn lower from then on, something good for the house building industry. The only problem being the share prices of the housebuilders had already moved up significantly in anticipation and I thought I had missed the boat.

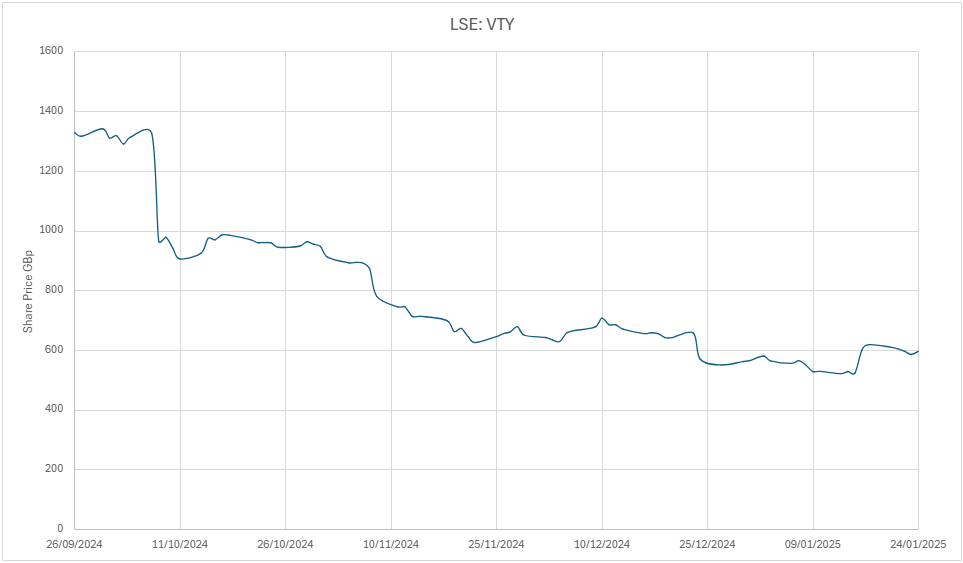

However, Vistry reported a profit warning in October 2024 reducing the expected profits for 2024 and 2025 somewhat, the share price dropped 24% that day.

Again a month later, Vistry reported costs were expected to be larger than initially thought, the shares dropped another 15% that day. Other housebuilders followed it down, but not losing as much. After a few weeks of further research, with Vistry steadily dropping another 12% over those weeks, I bought in at 650p in late November where I thought it had reached a bottom. This was more than a 50% drop since its peak in October 2024, 6 weeks earlier.

It looked like Vistry had reached a bottom until Christmas eve, when it reported it’s third profit warning in the space of 2 months, shares dropped 16%. I decided to buy more shares on this day at 575p with the remaining money available in my Stocks & Shares ISA. Not only was Vistry earning a lot less in 2024 but confidence in the business had significantly dropped.

The share price ticked down further in early 2025 until a trading update stated there would be no further earnings decline. Shares jumped 16% higher on the basis there was no more worsening news, but there was also no improvement at this time. This gave me confidence the share prices was excessively low and the market was just waiting for news which indicated the situation wasn’t getting any worse.

As of late January 2025, I was in for an average price of 620p and this represented about 11% of the account value. Vistry’s share price was sitting 55% below where it was 3 months ago.

New Strategy

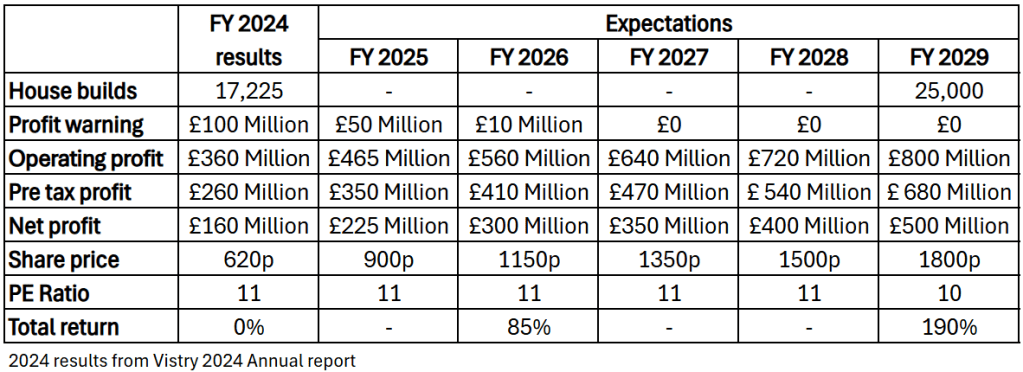

Using the new asset light strategy, the company set medium term targets of 40% Return on Capital Employed (ROCE) and £800 Million operating profit. This would result in expected net profit of more than £500 Million and a price to earnings ratio of less than 4 at the current January 2025 share price.

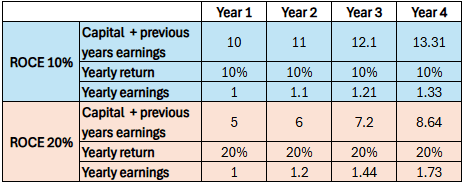

Although that profit is great, the 40% ROCE is the more attractive part. That is a fantastic return on capital that rivals the large American tech companies and suggests that £800 Million operating profit would only require £2 Billion of invested capital to generate it. For context, Vistry current uses £2.5 Billion of capital to generate its existing earnings. Even if it didn’t quite achieve those target numbers, it would still be great.

Vistry can target these returns as it is moving to a business model that is more asset light, requiring less money tied up in the company. It works with partners who eventually own the houses, but pre-sells them to the partners before they’re built.

So the partners fund these houses that Vistry builds, hence Vistry doesn’t need to use it’s own money to build the houses. A portion of the Vistry’s houses are built in this way already so the expected returns are known, the shift in strategy is to increase the portion of houses built in this way to 65% of the yearly total.

Higher return businesses are what investors look for, simply put they earn more from less capital. Also they can grow at a quicker rate when reinvesting the earnings as the example below shows.

Excess Capital Return

As part of the transition to an asset light strategy, less capital would be required in the business. Transitioning to this model allows Vistry to distribute this excess capital to shareholders as the business would no longer need it. They mentioned this would amount to £1 Billion over 3 years from September 2023.

By September 2024 £285 Million had been completed and/or announced up to May 2025, with my investments made in November and December 2024 I estimated £750 Million remained to be distributed at that point. My 620p average price values the company at £2.05 Billion, the £750 Million represents 36% of that total value. So the company should be returning 36% of the companies value to shareholders over 2 years just from those excess distributions.

Even if they extend the time beyond 2 years, it is not a problem as I plan to hold Vistry for many years. Changing the business to being asset light with high returns on capital, positioned in a market that has high growth potential is a recipe for great returns.

Low Valuation

These repeated profit warnings have reduced the confidence of the market in this company and it has given it a low valuation. Compared with other large housebuilders it is valued the lowest, that gives it the most amount of potential upside.

Government house building targets

The current Labour Government have set ambitious house building targets to address the long term housing shortage in the UK and are going to need the help of the private house builders to achieve it. The building target is more than 50% higher than what has actually been achieved in recent years. Relaxing planning reforms have been mentioned as a way to help enable this further.

Assuming they achieve the target 300,000 new homes per year, with 2.3 people living in each household (the UK average), that totals housing for about 700,000 people. That almost matches the population increase in the last 12 months. In other words, they need to achieve those increased building numbers just to match the current population growth rather than start reducing the shortage.

Pent-up demand

With higher mortgage costs and lower house sales for a few years, a back log has built up. When those interest rates drop and make mortgages more affordable, I expect an increase in house buying demand and sales.

In recent years, a slight drop in mortgage rates or upcoming increases in stamp duty when buying a house, has caused a bump in buyer demand. To me, this suggests there are a lot of people sitting on the sidelines that could buy now but are waiting for affordability to improve or to get a better deal.

Risks

The key risk is that interest rates remain elevated, leaving mortgage rates elevated as well. This would keep a lid on potential buyers and the demand for houses.

Elevated mortgage rates would also affect existing mortgage holders, it will sap their buying power through higher monthly costs. If they were intending to move to a more expensive house, they would be less likely and this would be another drag on house demand.

There is also potential the new strategy doesn’t work at an increased scale. If this were the case and a return to the original house building strategy had to be made, to replace the capital to do so would require a lot of borrowing or selling shares, or to just scale up slowly. Any of these options would likely limit total returns for many years. It may need many years just to break even again.

Return expectations

I have a very positive outlook for Vistry over a 3-5 year time horizon and have confidence in them achieving their medium term goals. Even when they have a bad year, they have a profitable year and I think the recent 50%+ drop in share price is excessive. However, the price drop did give me a great opportunity to buy in, without it I doubt I would own any.

The bulk of the £1 billion shareholder distribution should be in the form of share buybacks, as a long term shareholder I prefer this and in an ideal world, 100% would go to share buybacks.

None of the excess will be given to shareholders directly like with dividends but it will boost the earnings per share of the shares held and the returns should come to me via a higher share price. For a case study, have a look at the NVR Inc share price (NYSE: NVR) over 20/30/40 years. This is a US housebuilder that channels profits into share buybacks over the course of decades.

Currently I think Vistry fits into a low risk, high uncertainty category that Mohnish Pabrai has explained before. The market is giving it a low valuation because it has lost confidence and is confused between high risk and high uncertainty. I don’t feel the company is at risk of going out of business and it is still generating some profit, but there is some uncertainty around it’s performance and whether it’s strategy shift will work.

The share price is volatile and hasn’t really gone anywhere. If evidence starts to show the strategy is working, I think the share price will take off. That could be this year, next year or even later. It doesn’t matter to me as I am looking to hold the shares over at least a 5 year time frame.