Key Takeaways

- A play on the Covid-19 recovery.

- Feel the share price has lagged the actual cruise industry recovery.

- The positives outweigh potential risks.

Carnival (LSE:CCL, NYSE:CCL) is the largest cruise company in the world and the only cruise company available on the London Stock Exchange.

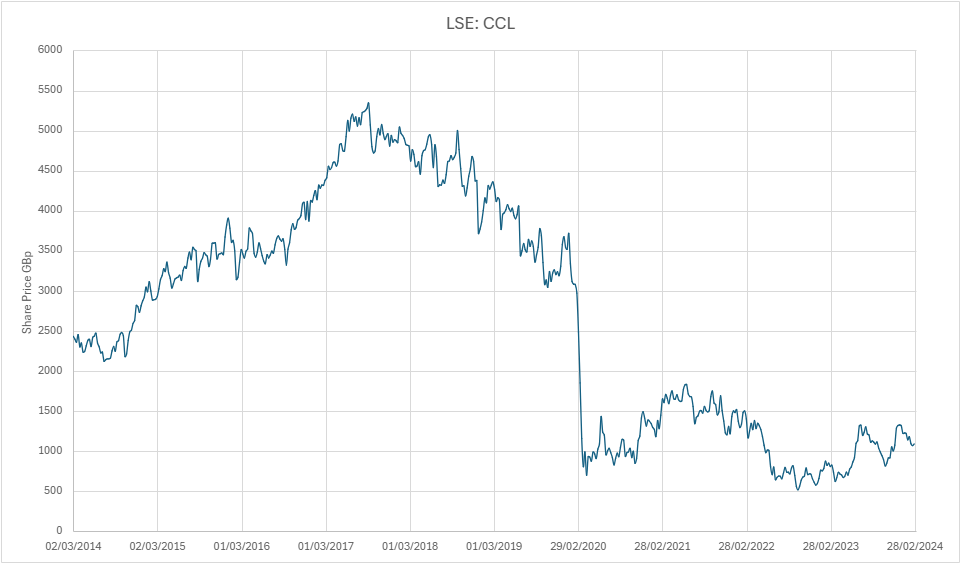

The cruise industry was one of the most impacted by the Covid-19 pandemic. Carnival survived the worst of the pandemic but was left badly damaged, kept afloat through binging on debt and issuing new shares. This damage and the uncertain road to recovery is what produced the chance to buy shares at a price significantly below what they sold pre-pandemic.

So what happened?

Everyone can understand the impact of Covid-19 on Carnival as it affected everyone personally. Going on holidays was practically non-existent for a while, you weren’t even allowed to leave your home without a valid reason during lockdowns.

Carnival’s revenue dried up but it still had some costs, and being fairly asset heavy these ran into billions of dollars each year. These costs were paid for by debt and new shares until the world opened back up when the threat from Covid-19 subsided and revenue started to return in 2021.

However, the share price took another step down to all time lows in 2022. The spiking inflation around the world led to dramatic increases in interest rates, making all that debt much more expensive. 2023 was record year for revenue, but generated no net profit as paying the interest due on the debt used all the leftover profit. However, zero net profit was a vast improvement compared with the previous years.

When and why I invested?

At the start of 2024, the majority of stock markets were at or near all time highs, even with interest rates elevated. This signalled that, on average, businesses across the board had recovered from the impact of Covid-19. However if you focused on specific industries, this wasn’t the case.

The cruise industry was an example of one with Carnival still 67% below its January 2020 price when it was valued on a price to earnings ratio of about 11. When factoring in the increase in the number of shares during the period, the companies market cap was down around 40% since January 2020.

I believe the amount of uncertainty was keeping the price down, but there was a lot of positive tailwinds shared below that should make the share price rise over time. But those aren’t guaranteed.

After doing some research into the cruise industry, the thing that actually convinced me to invest in Carnival was when someone at work who was very strict regarding Covid, was going on a cruise themselves. This was a signal to me that there was an opportunity here.

Although Carnival is not capital light and it’s Return on Capital Employed isn’t that great even before Covid, the price the shares are available at combined with the potential to increase earnings create the opportunity.

Positives

- Very low chance of further Covid lockdowns

By early 2024, it was a number of years since the last lockdown and mutations of Covid were becoming lower risk. Travel restrictions had been lifted and it looks likely we would not be returning to them. - Inflation has largely dropped and interest rates will follow

Inflation peaked in June 2022 in the USA and had largely dropped by June 2024. For other countries, the peak came around October 2022 and had dropped substantially by December 2023.

With inflation coming down meaningfully, the interest rate increases were paused in August/September 2023 and forecast to start decreasing during 2024. This means the worst of the debt expenses had past and will be decreasing from here at an accelerating rate as debt is paid off as well. - Cruise demand

The post lockdown the travel boom continues. Cruises are particularly popular due to their relative value compared to land based alternatives, as the inflation has pushed prices up.

Various cruise companies have reported record prices paid for cruises whilst booking volumes remain high and are increasing. This is also reported in future bookings which gives confidence that future years will be even better. This is important for the continued and consistent pay down of the debt going forward. - Free cash flow

Profits make the headlines but free cash flow is most important for Carnival. Free cash flow is the surplus money left over after operating expenses and capital expenditures are paid that can be distributed to shareholders, invested in the business or used to pay down debt.

From the full year 2023 report released in February 2024, Carnival reported a net profit of -$74 million whilst free cash flow was $997 million. This covered a large part of the debt repayment required in 2023, with cash covering the rest. This is due to increase in 2024 and should get to a point where it more than covers debt repayments due that year. - Fuel costs

Cruise ships are large and Carnival has a lot of them so fuel makes up a significant portion of it’s costs. Fuel costs have been high since Russia invaded Ukraine but are decreasing since 2022 and shouldn’t return to those previous prices. The money saved in fuel falls straight to profit which will help repay the debt and rebuild the balance sheet.

Risks

Part of the reason Carnival has the potential for great returns is due to it being in a somewhat risky position. Covid-19 was the reason it is in the position it is now and that caught everyone off-guard, I don’t think anyone would have believed the world would go in lockdown and practically grind to a halt in early 2020 if you told them before.

- Slow down or drop in cruise demand

A resurgence of Covid-19 leading to travel restrictions or lockdowns would put Carnival in a lot of trouble, with the amount of debt it likely wouldn’t survive very long. However it has been a number of years since the last lockdown and the world population is much better protected through vaccines and immunity.

I think the risk of this is very low going forward. Cruises and holidays in general are a luxury. If people become short on money, those are the sort of things that stop first. - Persistent elevated inflation keeps interest rates up

The cost of servicing debt is elevated compared to before with the higher interest rates, meaning it is more difficult for Carnival to reduce its debt. If inflation remains above target (2%) like it is forecast to do so, this will likely keep interest rates up.

What helps with this risk is a lot of the debt is fixed rate, so the total expense shouldn’t increase. Carnival is forecast to pay its interest and debt principal payments over the next year without the need to issue more debt. Even if interest rates stayed the same or went up slightly, the total expense will reduce. It is also forecast to increase profit and free cash flow further, so clearing the debt will come easier and easier.

I would argue slightly increased inflation and interest rates may actually be the best situation for Carnival. These are signs the economy is strong and should enable high levels of spending on cruises to continue, which is the key. A need to cut interest rate may indicate a struggling economy and disposable income spent on holidays may reduce. As things are, Carnival is able to pay of debt each year from net income alone without having to borrow more. Hence, continuation of the current circumstances is all that is needed. Inflation will also reduce the value of this existing debt at a faster rate.

Return expectations

Due to the risks and position of the balance sheet in early 2024, there have got to be good potential returns to make it worth taking the risks.

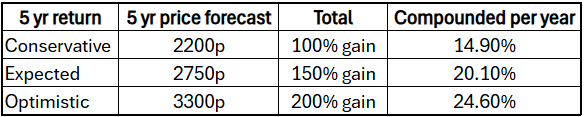

I don’t expect dividends or share buybacks from Carnival for many years, repairing its balance sheet is the focus and this will bring great returns through a major increase in its share price, if it succeeds. Anything further is considered a bonus. I invested in February 2024 at a price of 1090p when the full year 2023 results came out. Looking over a 5 year period I expect;

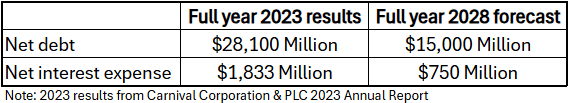

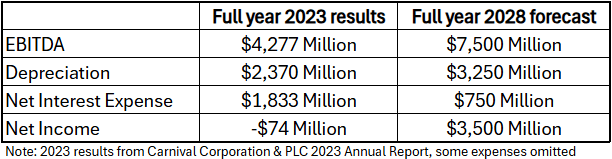

An average free cash flow and net profit of $2.6 Billion per year for 5 years used for debt reduction should decrease the net debt to $15 Billion, which I view as an acceptable amount for a company like Carnival. This should remove any discount priced in to the shares as the risks will be vastly reduced. This should lead to a saving of over $1 Billion in interest expense which will end up as additional profit.

A return to maximising occupancy, putting new ships into service and price inflation should lead to a notable increase in EBITDA. With depreciation and interest expenses subtracted, that should leave a net profit of at least $3.5 Billion or $2.5/£1.85 earnings per share in 5 years time (2028). Carnival was earning $3+ Billion in net income before Covid, so this figure may be conservative.

I believe there will always be a place for cruise holidays and Carnival will remain, or will be one of, the biggest provider. A holiday where the destination is somewhere new every few days isn’t really replicated by other holidays. Even though Covid decimated the industry and people were quite rightly fearful of getting too close to others during 2020-2022, it looks as if people are returning to cruising without much hesitation. Dare I say like Covid didn’t even happen. I’ll revisit Carnival in the future to see how things are going for the business and the investment.