Key Takeaways

- Compounding is the key, get it on my side rather than working against me.

- Compound investments at a high return for a long time, whilst leaving them alone.

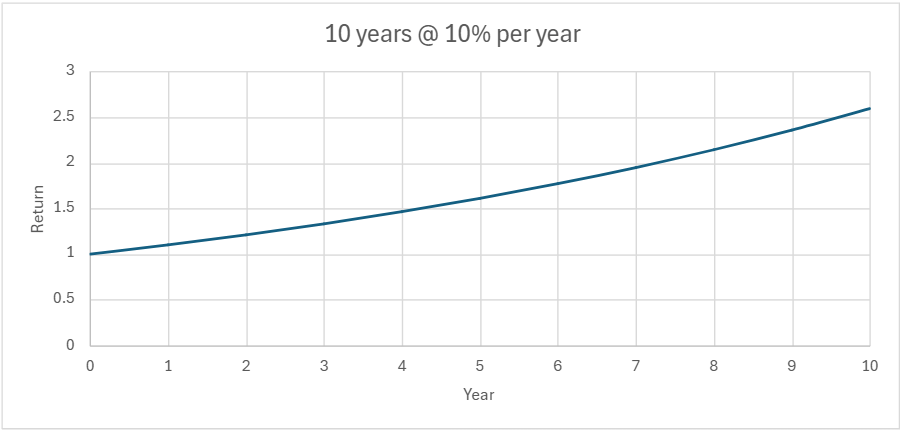

The number one thing that triggered my interest in investing and has influenced my decision making was the concept of compounding and what it is capable of. Nothing can demonstrate compounding better than a graph…

An initial £1 turns into £2.60

An initial £100 turns in £260

An initial £10,000 turns in £26,000

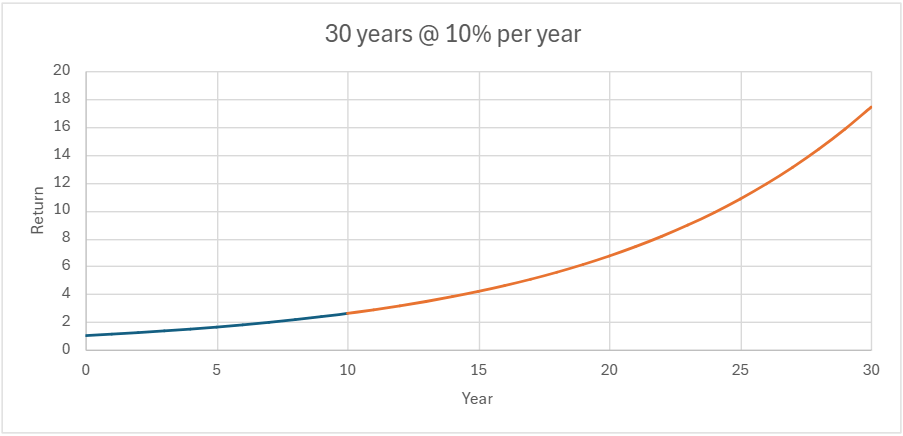

Starting with the same amount, invested at the same return for 3 times longer over 30 years results in…

An initial £1 turns into £17.45

An initial £100 turns in £1,745

An initial £10,000 turns in £174,500

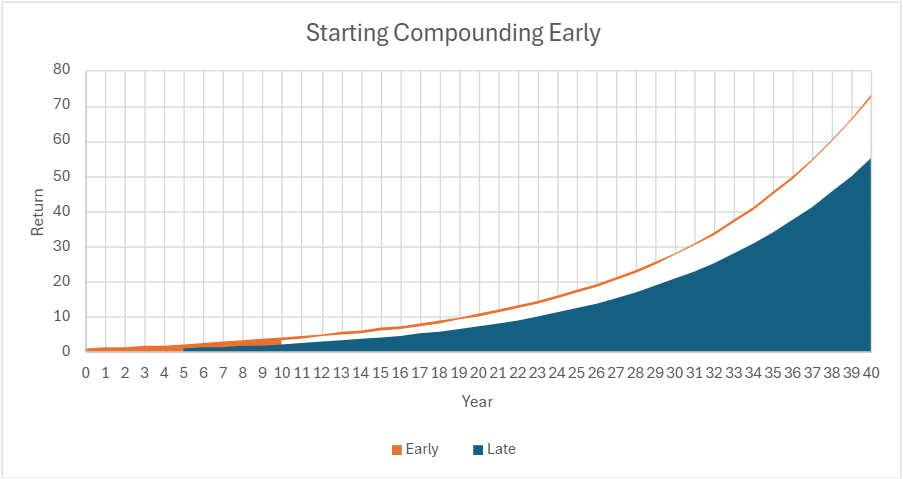

The benefits of compounding don’t appear to be that obvious early on, but the curve continues to steepen all the time. The rewards are loaded towards the back end, but consistency from the start and all the way through is vital.

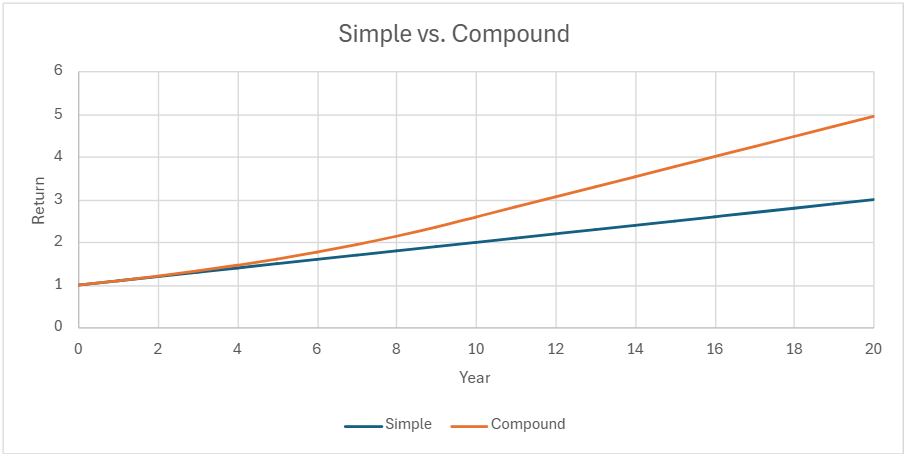

Wealthy investors like Warren Buffett and Terry Smith say compounding is the main reason for their success financially. In finance, compounding involves receiving a return on an investment, then reinvesting that return into further investments to receive an even greater return in the future. This is a form of delayed gratification, sacrificing something now in order to get more in the future.

Simple interest is collecting the return and using it for something else, this misses out on the benefits of compounding if it were reinvested.

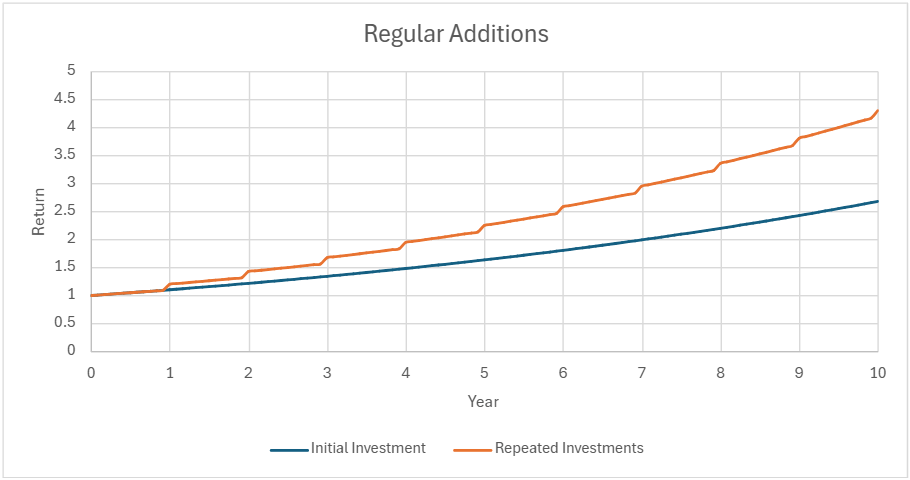

This compounding can be further turbocharged by contributing more money in addition to the reinvested returns.

The effect of compounding can be broken down into the rate of compounding per year (% return) and the length of time the compounding runs for. To make the compounding as long as possible, I need to start as early as possible, and then don’t interrupt it. This is the reason people are told to start a pension when they are young and start earning money, however small the contributions are. The benefits of starting early can be seen.

What is more telling is the orange line has only 10 years of contributions between between year 0 and 10. After 40 years it is a greater amount than starting at year 5 and contributing each year up to year 40 for the blue line. The difference between the two lines continues to grow larger after this.

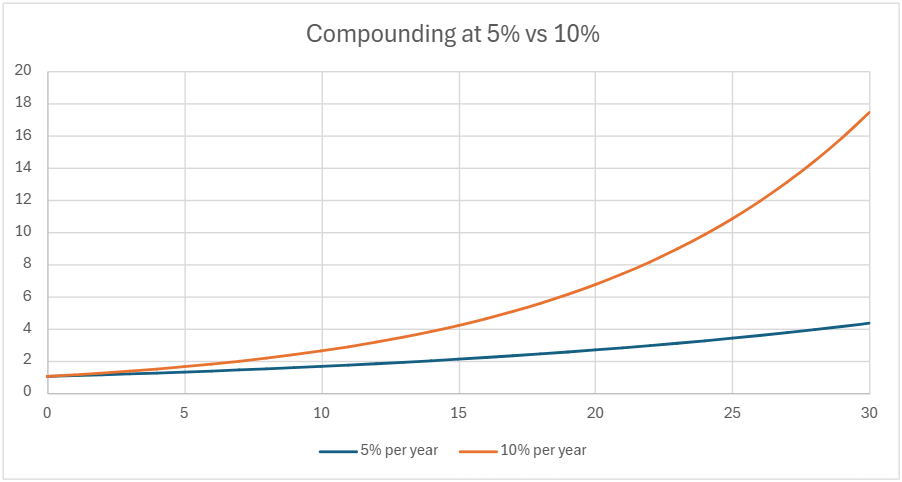

The rate of compounding is important but also deceiving. It may be assumed a 10% rate is twice as much as 5%, but applied over an extended period the difference is much greater than that. The longer it goes on, the bigger the difference. This makes the rate of return very important.

How I do it?

So, compounding is shown to be incredibly powerful and the key to growing wealth, I can get its benefits through investing. To maximise this benefit for me; I need to…

- Start as early as possible

- Get a high rate of return

- Regularly contribute additional money

- Don’t withdraw from it

Start early

According to the order to do things list I didn’t start as early as I could, I did the next best thing which was to start at that point, when I was 27. I already had a Help to Buy ISA and savings, but the savings weren’t being used effectively within investments. I hadn’t really looked into investing much at that point. Spending time reading into it and listening to some experts gave me the confidence to open a Stock & Shares ISA and make a start. I also had a reasonable house deposit saved at this time to get get over the hurdle to home ownership, which gave me more flexibility to invest.

Part of the reason I didn’t start earlier is; life is expensive. Salaries are lower when you’re younger and university delays receiving that salary further too if you go. I didn’t have much left over from the monthly pay checks to even start saving a decent amount until a few years into my career. The order to do things page shows when different aspects are available from, and it was just a case of using them when I could.

High rate of return

As someone who wants the best possible returns over a long time, I have to invest in shares. The major indices of various countries, like the FTSE 100 and S&P 500, have long term average returns of 7-10% annually. It is not a coincidence the wealthiest people on earth got that way by owning significant holdings of shares in public and private companies. Many of the world’s top investors mainly or only invest in shares. I will copy this by mainly holding shares in my Stocks and Shares ISA and investment account.

Regularly contribute additional money

I will make regular contributions to my Stocks & Shares ISA each year to help it grow faster. Residents of the UK are very lucky to have ISAs that are one of the best tax efficient investment accounts in the world. Yearly contributions of up to £20,000 can be made, this is a lot each year but will be the target to aim for to maximise the benefit.

Don’t withdraw from it

With the benefits of compounding, it’s best to leave it alone to continue uninterrupted. By not withdrawing anything, the compounding is maximised. But how do I ever benefit if I don’t withdraw anything? I intend to through borrowing money against it in various ways.

Some mortgage providers recognise investment returns as income, boosting my total income when combined with my job’s salary and increasing the amount that can be borrowed on a mortgage. This makes the required deposit smaller, meaning some money remains in my pocket (or my investments). The mortgage will be bigger, but it’s extra cost will be more than offset by my average investment returns (provided the investment return is greater than the mortgage rate of interest). Depending on the mortgage interest rates in the future, I intend to have a mortgage well into retirement and don’t ever plan to pay it off early unless interest rates rise significantly.

When a certain level of wealth is reached, banks offer loans secured against assets. This is from the Wealth Management part of the banks and investable assets of £500,000+ are normally required to start qualifying for these services. Similarly to a mortgage being secured against a house, these loans will be secured against shares or bonds I would own. I’m a long way from qualifying for this at the moment, but it is something to plan for the future when, hopefully, it becomes available to me.

Unsecured forms of lending are available to, for example loans and credit cards. I’ve already mentioned credit cards can be a very cheap way of borrowing, if you avoid the normal interest rates on them. Provided the rate of interest on he money borrowed is beneath the return on investments held, it is worth leaving the investments to compound and use a loan.

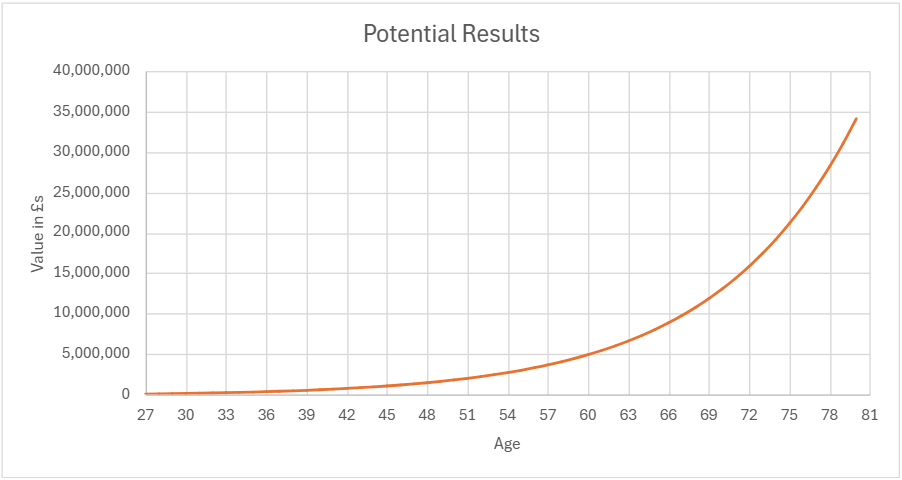

Potential results

For motivation to start with and to keep up with the strategy consistently, it is worth having a look at what the results could be. To make it as realistic as possible for me, I’ve started at an age of 27 and will max out the £20,000 ISA contribution each year. This has been the case so far and will continue until 80 years old with a modest yearly return of 10%, and the result of this…

From a total contribution of around £1 million (£20,000 for 54 years), the result is amazing! But more importantly, very achievable. If I keep this up, this will be the result.